accumulated earnings tax reasonable business needs

CODE OF 1954 531. 150000 200000 - 100000 250000.

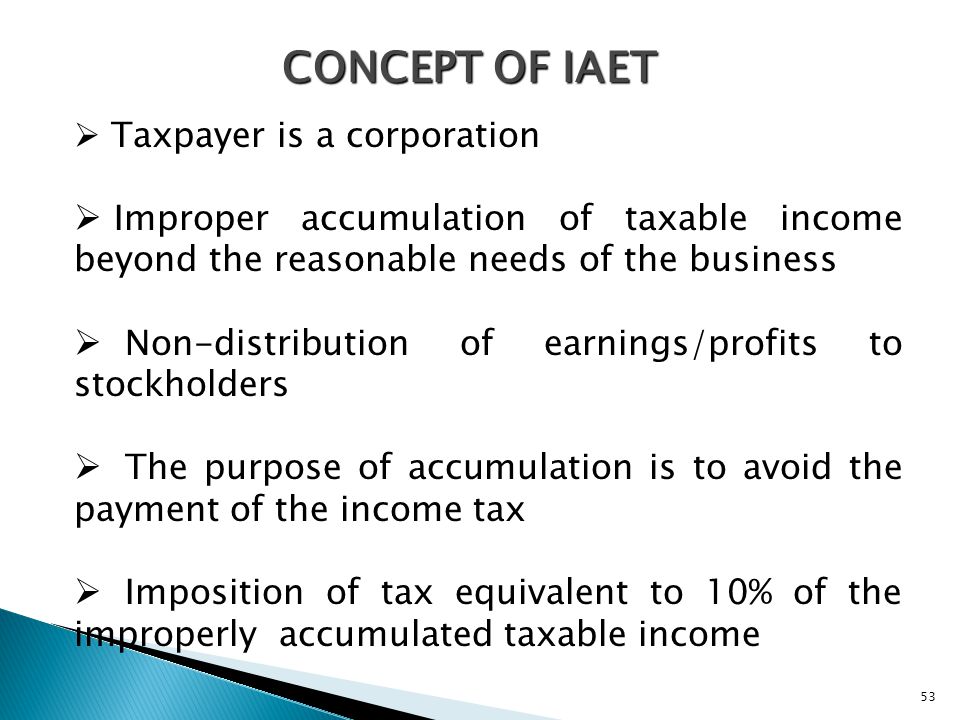

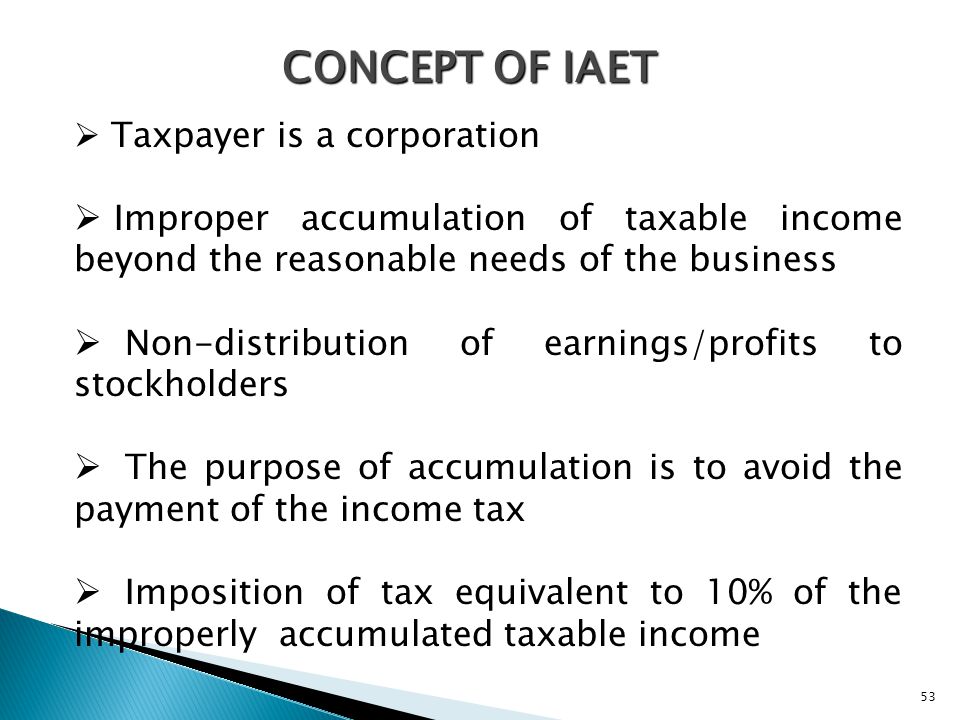

Overview Of Improperly Accumulated Earnings Tax In The Philippines Tax And Accounting Center Inc

The accumulated earnings tax which is imposed on corporations for the accumulation of earnings in excess of reasonable business needs does not apply to.

. The term section 303 redemption needs means with respect to the taxable year of the corporation in which a shareholder of the corporation died or any taxable year thereafter the amount needed or reasonably anticipated to be needed to make a redemption of stock included in the gross estate of the decedent but not in excess of the maximum amount of stock to. And profits have been allowed to accumulate beyond the reasonable. 20 of the rent.

This tax was created to discourage companies from withholding profits and paying dividends. B Reasonable anticipated needs. Tax on Accumulated Earnings.

Retain earnings for reasonable business needs and document them in a specific definite and feasibleplan. The accumulated earnings tax which is imposed on corporations for the accumulation of earnings in excess of reasonable business needs does not apply to which of the following a closely held corporations b widely held corporations c corporations subject to the personal holding company tax or d both b and c. The extent to which earnings and profits have been distributed by the corporation may be taken into account in determining whether or not retained earnings and profits exceed the reasonable needs of the business.

1 Accumulated taxable income is taxable income modified by adjustments in 535 b and as reduced by the dividends paid deduction under 561 and the accumulated earnings tax credit under 535 c. Tion of earnings beyond the reasonable needs of the business betrays the prohibited purpose4 In practice the presumption is virtually con-1. 150000 200000 - 100000 250000.

Essentially the accumulated earnings tax is a 15 tax on the corporations accumulated taxable income for the tax year. A holding company may accumulate earnings for the reasonable business needs of its subsidiary and likewise the subsidiary may accumulate earnings for the reasonable business needs of its parent. See Inland Terminals Inc.

The accumulated earnings tax has been referred to as a penalty on success itself Of all the taxes imposed upon business this is probably one of the most unpopular involving an after the fact verdict on manage-ments business judgment. See 1537-2 relating to grounds for accumulation of earnings and profits. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings.

Generally speaking a corporations accumulated taxable income is calculated as follows. The accumulated earnings tax. In the case of a corporation other than a mere holding or investment company the accumulated earnings credit is an amount equal to such part of the earnings and profits for the taxable year as are retained for the reasonable needs of the business 26 USC.

THE ACCUMULATED EARNINGS TAX AND THE REASONABLE NEEDS OF THE BUSINESS. Corporations subject to the personal holding company tax. The issue will be dropped if it is concluded that earnings and profits have not been accumulated beyond reasonable business needs.

Reasonable business needs versus tax avoidance by Machinery and Allied Products Institute unknown edition. Accumulated Earnings Credit. To avoid having to pay for accumulated earnings tax Company A has to distribute at least 100000 of net income as dividends.

However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. V US 477 F2d 836 4 th Cir. The accumulated earnings tax.

The US tax service considers an amount greater than this amount to exceed reasonable business needs. Group of answer choices. The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income.

However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. THE MECHANISM IMPOSING THE ACCUMULATED EARNINGS TAX. If Company A wishes to.

The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. Ad Potentially Remove Payroll Tax for Small Business Owners Impacted. Reasonable business needs versus tax avoidance by Machinery and Allied Products Institute 1967 edition in English It looks like youre offline.

Consideration should be given to the relationship between IRC 531 Imposition of accumulated earnings tax IRC 541. To avoid having to pay for accumulated earnings tax Company A has to distribute at least 100000 of net income as dividends. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

Receive Your Employee Retention Tax Credits Fast. This is a federal tax levied on businesses that are considered invalid and have above-average incomes. If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes is beyond the reasonable needs of the business the corporation may be assessed tax penalty called the accumulated earnings tax IRC section 531 equal to 20 percent 15 prior to 2013 of accumulated taxable income.

And profits have been allowed to accumulate beyond the reasonable. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder - level tax seeSec. Čeština cs Deutsch de English en.

Track Your Expenses Easily With QuickBooks - Highly-Rated Tracking Software. The accumulated earnings tax. The Accumulated Earnings Tax The accumulated earnings tax is a penalty tax designed to dis- courage the use of a corporate umbrella for personal income.

Within the reasonable needs of the business rubric. Trol is shifted The crucial issue for purposes of the tax on accumulated earnings is whether the accumulation should be characterized as under-taken for the corporations reasonable business needs or for the redeemed shareholders tax benefit. Ad Easily Track Your Business Expenses - Get Started With QuickBooks Today.

In periods where corporate tax rates were significantly lower than individual tax rates an obvious. Both b and c.

:max_bytes(150000):strip_icc()/GettyImages-1089395350-f33f180d2b234b268f6df527045f8de0.jpg)

Accumulated Earnings Tax Definition

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

Income Tax Computation For Corporate Taxpayers Prepared By

Darkside Of C Corporation Manay Cpa Tax And Accounting

Income Tax Computation For Corporate Taxpayers Prepared By

Income Tax Computation For Corporate Taxpayers Prepared By

Doing Business In The United States Federal Tax Issues Pwc

Improperly Accumulated Earnings Mpcamaso Associates

Darkside Of C Corporation Manay Cpa Tax And Accounting

Prepared By Lilybeth A Ganer Revenue Officer Ppt Download

Income Tax Computation For Corporate Taxpayers Prepared By

/GettyImages-1130199515-b011f8c58a144789b22c7107929ffb8f.jpg)

Accumulated Earnings Tax Definition

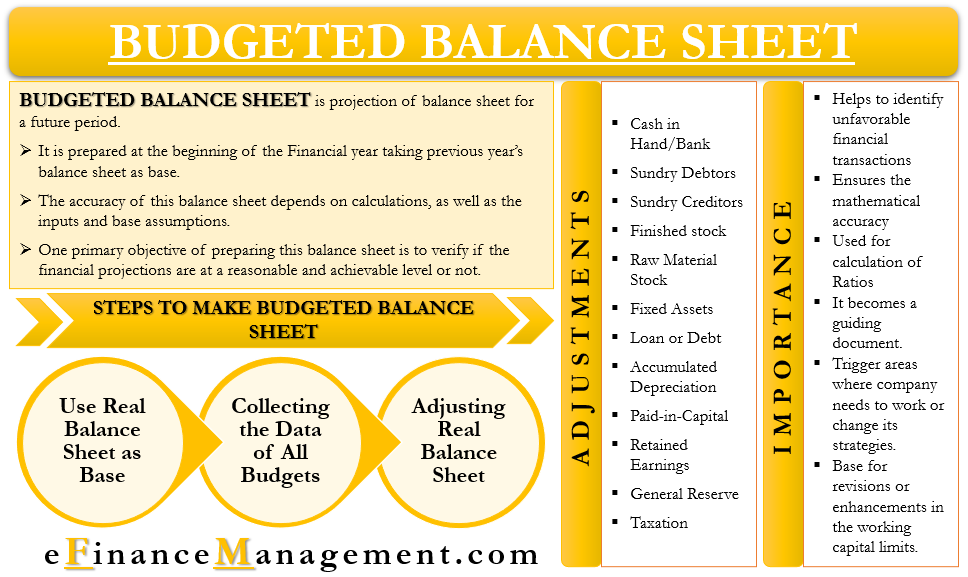

Budgeted Balance Sheet Importance Steps Adjustments And More

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download